ABOUT BAITULMAL

We are a

pioneering and indigenous Islamic

financial institution committed to delivering

Shari'ah-compliant wealth management services

with an ultimate goal of transforming

livelihoods of communities.

To complement Uganda's Islamic financial

ecosystem, we explore the untapped investment

opportunities and cater for different risk,

return, maturity, and liquidity needs of various

agents in the economy.

We holistically manage our Clients' wealth cycle

through a wide range of Shari'ah compliant

solutions including; investment management,

financial planning, tax planning, estate

planning, retirement planning, and risk

management among others.

Core values

- Honesty.

- Transparency.

- Accountability.

- Social Responsibility.

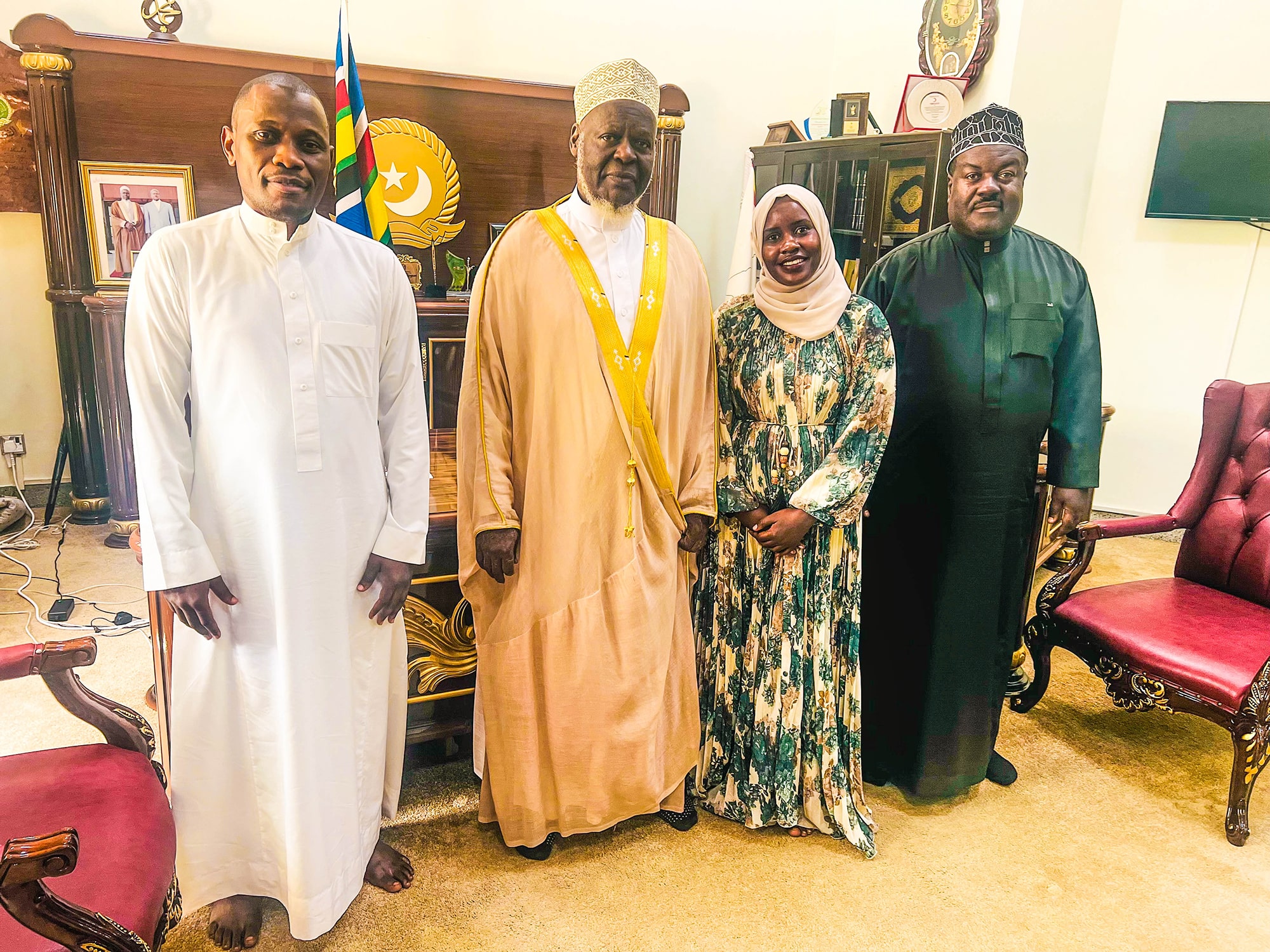

OUR TEAM

Hajji Musoke Jamadah Lutta

More info

He is seasoned accountant and businessman.

Who is the Executive Chairman and founder of J. Lutta & Vo. Inc.,

specializing in Coffee & Horticultural export.

Previously, he was a shareholder/Director of Greenland Bank Ltd.

He has a B. Com (Accounting) from New Delhi Commercial University India,

a fellow member of Chartered Institute of Accountants of India (FICA),

and a fellow member of the Institute of All India Auditors (FSAA).

Dr. Lujja Sulaiman (CSAA)

More info

Lujja is a seasoned banker, Islamic finance expert, Shari'ah advisor, and Shari'a auditor.

Previously, he headed Islamic banking and Islamic investments departments at Tropical bank and Microfinance Support Centre.

He participated in the process of amending Uganda's legal framework to accommodate Islamic banking and finance and has worked with Government bodies, NGOs and the Private sector to develop Uganda's Islamic financial sector.

He holds a PhD and an MBA in Islamic Banking and Finance from Malaysia, a Bachelor's Degree in Shari'a from Saudi Arabia, and a Bachelor's Degree in Accounting.

Professionally, he is a Certified Shari'a Adviser and Auditor (CSAA) from the Bahrain-based Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Nabukenya Faridah

More info

She is a highly skilled finance specialist with over 15 years of experience in financial planning, investment strategy, and risk management.

She has successfully served at different institution both public and private, government and Non-Government Organizations (NGOs).

She holds a Masters in Islamic Banking and Finance (MIBF) from Islamic University in Uganda (IUIU), a post graduate diploma in Human Resource Management and a Bachelor of Commerce from Makerere University Kampala (MUK).

Hajjat Nakirijja Jamidah

More info

She is a Businesswoman and a co-founder / Director of Diwan Islamic Finance Agency.

She is a Human Resource and Administration expert with a Masters of Business Administration (Human Resources Management and Administration specialization) and a Bachelor's degree in Human Resources Management & Administration.

She has organized and led livelihood transformation initiatives for different Women groups, improving their knowledge, financial literacy, and teamwork skills.

Counsel. Muhamad Ali Aluma

More Info

He has over a decade of combined professional experience in administration, management, lecturing and legal services.

He holds an honors Bachelor of Laws Degree, a post graduate diploma in legal practice from LDC, and a Masters in Law (LLM).

He currently serves as Assistant Secretary General, Uganda Muslim Supreme Counsel (UMSC).

He is a professional associate with over a decade's experience in several well-established busy organizations, with interests and expertise in law practice.

Mr. Moses Bazibu

More info

He is a seasoned risk management professional with over a decade and a half of experience in ethical governance, financial oversight, and humanitarian operations across Africa, MENA, and Europe.

Currently serving with UNHCR Sudan, he champions risk management, integrity and ethical conduct, inclusive growth, and resource safeguarding.

He holds a Master's in Accounting and ACCA (UK) certified.

His people-centered approach & commitment to ethical wealth stewardship resonate with BAITULMAL.

Dr. Ahmed Moses

More info

He is a qualified educationist who has taught in Uganda, London (UK) and Rwanda.

Worked as Dean, Faculty of Business and Management and later rose to Deputy Vice-Chancellor in charge of Academics at the University of Kigali Rwanda.

He worked at Greenland Bank.

Ahmed holds a PhD Islamic finance and Banking (London), MBA UEL – (London), Post Graduate Diploma in Education (PGDE)- IUIU Uganda, and Bachelors: (B.A) – IUIU – Uganda.

Dr. Kiyita M. Kyambadde (FCCA)

More info

He is a Public Financial Management, accounting, auditing and project management expert with over 33 years of practical experience in these fields.

He has worked for various International Programmes and projects management firms.

He has membership certification as; FCCA (UK), FCMA (UK), CPA (U), CGMA (USA), AIA, (UK). MCIPS-UK, PMP-Israel, CDIF-UK, CIIF, (Malaysia), holds a B.com (MUK), four Masters degrees in Accounting and Finance, Islamic Finance, Project Management and PhD in Islamic Finance.

Mahawuya Kabuye Kasujja (FCCA)

More info

He is an Islamic Finance Advisor with added expertise in Finance and Tax Advisory who graduated from Qatar-Foundation's Hamad Bin Khalifa University (HBKU) with a MSc in Islamic Finance, Bachelor of Commerce in Accounting from Makerere and Member of ACCA.

He is currently pursuing a MSc. Taxation at the University of Oxford.

He has also previously worked as a Financial and Tax Advisor at Ernst and Young Qatar, France Telecom-Orange (U) Ltd and Ernst and Young Uganda.

Sheikh Ausi Lutaaya

More info

He is a renowned Islamic scholar and educator with over 25 years of experience in Islamic jurisprudence, finance, and community leadership.

He has served as a Shari'ah advisor for various Islamic financial institutions and organizations across East Africa, providing guidance on compliance with Islamic principles.

He holds a degree in Islamic Studies from Al-Azhar University in Egypt and is a respected member of several Islamic scholarly councils, including serving as a member of the Shari'ah Board for the Central Bank of Kenya and advisor to various Islamic NGOs and community organizations.

PARTNERS

- Uganda Muslim Supreme Council (UMSC)

- House of Zakat & Waqf Uganda (HZWU)

- Diwan Islamic Finance Agency

- Uganda Muslim Education Association (UMEA)

- Uganda Muslim Teachers' Association (UMTA)

- The Islamic Medical Association of Uganda (IMAU)

- Bilal Staff Savings and Credit Cooperative Society (BISTSACCO)

.png)

This is the mother, apex and governing body of Muslims in Uganda, who constitute 6.5 million according to Uganda Bureau of statistics (UBOS). UMSC structures include; over 9 Regional Administrative Structures for easy service delivery and 78 Muslim Districts, 465 Muslim Counties and over 13,000 Mosque. It manages several Muslim-based institutions including; hospitals, health centres, Universities, post-secondary institutions, secondary schools, primary schools, Uganda Muslim Medical Bureau, radio and TV stations among others.

.png)

This is a non-denominational and not for profit organization set up to manage and administer Zakat (obligatory dues) and preservation of Waqf (endowment) in accordance with the teaching of the Holy Quran, Hadith, Consensus and Analogy for the social wellbeing of Muslims and development of Islam.

This is a one-stop centre for Islamic finance sector development through training, research and publication, and Shari'ah advisory services in areas of finance, zakat, waqf, and estate management. Diwan agency plays a vital role in the development of Islamic finance industry in Uganda through advisory, training and development of Human capital in the field of Islamic finance and Shari'ah. Diwan's commitment to excellence has strengthened its position as the top provider of quality training across all major Islamic finance disciplines. Diwan agency training arm specializes in industry technical certifications. The certifications are designed to ensure attainment of technical proficiency levels to fulfill jobs requirement and support professionalization of the industry. Diwan serves as a partner to numerous world class institutions; delivering thought leadership, research, advisory, assessment and training in various Islamic finance fields.

.png)

This was established in 1936 to work as a Muslim Secretariat that serves Ugandan Muslims. It aims at providing a platform for Muslims to achieve sound education (modern and traditional Islamic studies) purposely to attain a reasonable share in their country as their counterparts of other religious affiliations.

.png)

This is an umbrella body that brings together Muslim teachers in Uganda so they increase access to quality education of the Muslim community as well as improving Teachers' welfare. UMTA was established in 1988 as a national non-governmental not for profit organisation working across the country. UMTA units Muslim teachers irrespective of their social and political affiliation.

.png)

This is a registered non-governmental organization established in 1988. The membership of the Association consists of Muslim health professionals who form the General Assembly, the association's highest authority. IMAU targets all people of Uganda but with a comparative advantage with Islamic communities.

.png)

SACCOs in Various Institutions. We establish Islamic financial cooperatives (Baitulmal Wat Tamwil) in different institutions who are our implementing partners established as standalone or Windows in conventional financial institutions including; Cooperatives, Savings and Credit Cooperative Societies (SACCOs), Groups, Microfinance Institutions (MFIs), Small and Median Enterprises (SMEs), and other development institutions. One of the model reference SACCOs we have supported is Bilal Staff Savings and Credit Cooperative Society (BISTSACCO)